The Research and Innovation Scheme for Companies (RISC), administered by the Singapore Economic Development Board (EDB), is a strategic partnership designed to encourage established companies to deepen their technological capabilities and develop proprietary products and processes from Singapore.

For large local enterprises and multinational corporations (MNCs) with significant, multi-year R&D roadmaps, RISC serves as a vital financial anchor, de-risking the capital and operational expenditure required for high-impact innovation. Understanding the scheme’s strategic intent is the key to securing this long-term funding.

RISC targets projects that demonstrate both technological complexity and a clear line of sight to economic value for Singapore. This scheme is structured to support companies making substantive, long-term commitments to R&D.

| Eligibility Criterion | Strategic Imperative |

| Project Type | Development of proprietary technologies, products, or processes that go beyond routine engineering and leverage advanced R&D. |

| Project Scope | Projects must typically be substantial, encompassing multiple workstreams and a minimum eligible cost that justifies EDB support. |

| Economic Outcome | Projects must contribute positively to Singapore’s economy, such as high-value job creation, capability transfer, or development of a new industry segment. |

| Company Scale | Typically aimed at larger companies (LEs and MNCs) that possess the internal capacity and financial stability to undertake and sustain long-term R&D. |

RISC effectively acts as a strategic co-investment, signaling the EDB’s confidence in the company’s ability to execute a large-scale innovation agenda.

Unlike short-term grants, the defining feature of RISC is its long-term tenure, which is crucial for complex research programs.

RISC awards typically span three to five years initially, providing the financial certainty necessary for research and product development that requires multiple stages of experimentation and refinement. This multi-year certainty is invaluable for:

This approach ensures that projects are not prematurely curtailed due to funding cycles, aligning the financial commitment with the biological timeline of innovation.

Securing a RISC award is fundamentally about demonstrating alignment with the EDB’s economic development goals. Maximization is achieved through rigorous preparation and articulation of value.

The funding covers key expenditure categories, including:

A successful application requires meticulously structuring the financial model to isolate and justify every dollar of support requested, linking it directly back to the project’s technical deliverables and the promised economic outcomes (e.g., jobs and total business spending).

It is crucial to understand how RISC interacts with other incentives, particularly the Enterprise Innovation Scheme (EIS), to ensure a globally optimized R&D strategy.

For all qualifying companies in Singapore, the Estimated Chargeable Income (ECI) filing is one of the first mandatory steps in the annual Corporate Income Tax (CIT) cycle. While often viewed as a mere compliance requirement, a strategic approach to ECI submission presents a significant opportunity to substantially enhance cash flow management right from the start of the financial year.

This article details why integrating your anticipated claim under the Enterprise Innovation Scheme (EIS) into your ECI filing for Year of Assessment (YA) 2026 is the most prudent financial decision for your business.

Companies with annual revenue exceeding S$5 million or those with a positive estimated chargeable income are generally obligated to file their ECI within three months after their Financial Year End (FYE).

Upon ECI submission, IRAS issues a Notice of Assessment (NOA), which sets the quantum for your company’s monthly CIT instalment plan.

A common pitfall in Singapore tax compliance is the practice of estimating ECI using only core revenue and deductible expenditure, reserving complex claims like enhanced tax deductions for the final tax return submission (Form C-S/C) in November.

This conservative approach has a direct negative impact on your working capital:

The consequence is clear: your company pays more tax than is ultimately due, tying up capital until IRAS processes the final claim and issues a refund months later. This is an unnecessary strain on your business cash flow.

The Enterprise Innovation Scheme (EIS), available from YA 2024 to YA 2028, is a robust government incentive offering enhanced tax deduction benefits for qualifying innovation and Research & Development (R&D) activities.

The EIS provides a 400% tax deduction on the first S$400,000 of annual qualifying expenditure across various categories, including:

By accurately factoring in this 400% tax deduction on your projected R&D expenditure or innovation costs when calculating your ECI, you immediately reduce your estimated Chargeable Income. This results in a proportionally lower tax assessment from IRAS, leading to a smaller, more manageable tax instalment plan.

| Scenario | ECI Calculation Approach | Tax Instalment Impact | Cash Flow Outcome |

| Traditional Method | Excludes EIS Claim | Higher Initial Payments | Capital is locked up with IRAS |

| Strategic Method | Includes EIS Claim | Lower Initial Payments | Capital is retained for business operations |

The EIS offers eligible companies the option to convert up to S$100,000 of total qualifying expenditure per YA into a non-taxable EIS Cash Payout of S$20,000 (20% conversion ratio), subject to meeting certain local employment conditions.

Crucially, submitting your EIS claim documentation early alongside your ECI, rather than waiting for the November Form CS/C deadline, allows your claim to enter the IRAS review pipeline outside of the peak corporate tax season.

This earlier submission often leads to a speedier review process, which is particularly important if your business relies on the EIS Cash Payout to finance ongoing operations or future innovation projects.

A successful ECI filing that incorporates the EIS benefit requires a precise and compliant estimation of your qualifying expenditure. Miscalculation or insufficient documentation can lead to a revised assessment and unnecessary complications.

FI Group Singapore are specialists in R&D and innovation tax incentives. We help companies:

Don’t wait, book a meeting with our experts to review your eligibility and strategic options for claiming the Enterprise Innovation Scheme in your YA 2026 ECI filing.

The Singapore government has unveiled the Research, Innovation and Enterprise (RIE) 2030 Plan, the nation’s most ambitious five-year blueprint for scientific development and technological transformation. With a massive commitment of S$37 billion, a significant increase from the previous RIE 2025 plan, understanding these national priorities translates directly into public funding opportunities for companies that can effectively align their R&D strategy with the plan’s key domains.

For multinational corporations (MNCs) and local enterprises alike, RIE 2030 sets the definitive agenda for where public-private research partnerships will thrive, ensuring Singapore remains a vital hub for innovation in the volatile global landscape.

The RIE 2030 plan is the nation’s strategic roadmap for the next five years, designed to strengthen national competitiveness and societal resilience by prioritizing key scientific and technological domains.

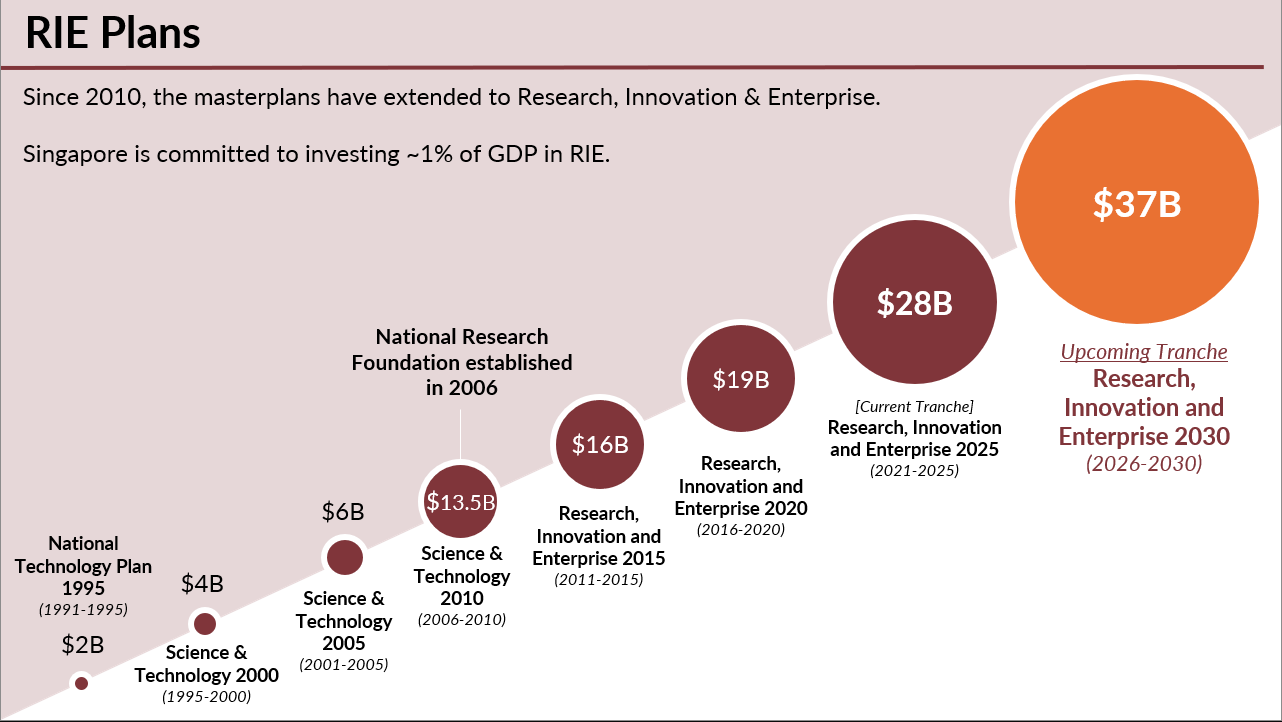

This commitment represents an exponential evolution in Singapore’s long-term investment in R&D. Since the RIE masterplans began in 2010, the financial allocation has consistently increased, growing from S$16 billion in RIE 2015 (2011–2015) and S$28 billion in the current RIE 2025 plan (2021–2025), to the upcoming S$37 billion commitment for RIE 2030 (2026–2030). This massive scaling of the budget underscores Singapore’s ambition to remain a global R&D hub. Understanding these national priorities translates directly into public funding opportunities for companies that can effectively align their R&D strategy with the plan’s key domains.

Source: National Research Foundation

The funding allocation directly reveals the government’s priorities, highlighting areas where companies can expect the most robust support and collaboration:

| Allocation Area | Budget Share | Focus for Companies |

| Mission-Oriented R&D (Four Domains) | 29%

(S$10.8 Billion) |

Direct research in key economic and social sectors. |

| Innovation & Enterprise | 20%

(S$7.5 Billion) |

Supports commercialization, venture building, and deep tech cluster growth. Crucial for grants and scaling. |

| Foundational Research | 24%

(S$8.9 Billion) |

Strengthens university and A*STAR capabilities, offering partnership opportunities. |

| Talent Development | 10%

(S$3.5 Billion) |

Nurturing R&D talent; supporting manpower schemes and research attachments. |

RIE 2030 maintains and sharpens the focus on four key domains. For companies seeking to anchor their R&D activities in Singapore, aligning your innovation strategy with these pillars is paramount for securing funding and maximizing impact.

This domain aims to reinforce Singapore’s position as an advanced manufacturing and logistics powerhouse.

A focus on building Singapore as a biomedtech and biomanufacturing hub, while addressing demographic shifts.

Driving Singapore’s transition to a climate-resilient and sustainable future.

Deepening capabilities in frontier digital technologies to drive the Smart Nation ambition.

The RIE 2030 plan explicitly earmarks S$7.5 billion for Innovation & Enterprise, signalling a clear commitment to moving research out of the lab and into the market.

For Companies, This Means:

The S$37 billion RIE 2030 plan is a monumental opportunity, but navigating the complex landscape of government funding, program alignment, and R&D strategy can be challenging.

As experts in innovation funding FI Group Singapore is uniquely positioned to help your company create and leverage these opportunities:

Don’t let this five-year window of unprecedented investment pass your company by. The time to integrate your innovation agenda with RIE 2030 is now.

To learn how FI Group can strategize your R&D projects to secure funding and establish a lasting strategic R&D foothold in Singapore book a meeting with out experts.

Singapore and the UK have built a strategic partnership around science, technology and innovation, backed by joint R&D calls and complementary tax incentives. For CFOs, this corridor is a practical route to fund international expansion, test products in two sophisticated markets and secure non-dilutive capital at group level. FI Group has strategic R&D Tax and Grants teams in over 20 countries around the world, including a specialist team of innovation funding experts in the UK.

Singapore and the UK collaborate through long standing science partnerships, a digital economy agreement and regular joint R&D calls co-funded by Innovate UK and Enterprise Singapore. These programmes back business led industrial research that can scale in both markets and internationally.

The Partners in Science programme launched in 2004 created the first structured channel for UK–Singapore research links, focusing on joint projects and mobility of scientists.

In 2023 the two Prime Ministers signed a Strategic Partnership that explicitly elevates cooperation on research, science, innovation and technology. This sits alongside pillars on economic, defence and green economy collaboration, signalling that innovation is a core diplomatic priority rather than a side topic.

The relationship is reinforced by a pioneering Digital Economy Agreement, which reduces friction for cross border data flows, digital trade and fintech, making it easier for digital R&D projects to operate seamlessly across Singapore and the UK.

At the operational level, joint programmes translate strategy into funding:

For a Singapore headquartered business, these calls are a way to de-risk market entry into the UK by sharing costs with a local partner and two funding agencies.

On top of grants, both jurisdictions run powerful R&D tax regimes.

In Singapore, the Enterprise Innovation Scheme (EIS) significantly enhances existing R&D deductions from YA 2024 to YA 2028. Companies can benefit from elevated deductions on qualifying R&D, innovation and capability development spend, and in some cases convert part of that benefit into a cash payout.

More broadly, Singapore combines volume based R&D super-deductions with other innovation incentives. FI Group’s international benchmarking shows that headline support can reach around a 68 percent after tax benefit on the first S$400k of qualifying spend, putting Singapore among the most generous regimes globally.

The UK, meanwhile, is shifting to a single R&D expenditure credit model with a 20 percent headline rate and enhanced support for R&D intensive SMEs. That new structure sits on top of a large, mature R&D tax credit system, which supported around £46.1 billion of R&D expenditure in 2023–24.

For CFOs, the opportunity is to design projects that qualify under both systems while respecting each tax authority’s rules on cost allocation and avoiding double counting.

For Singapore, the UK is more than a historical partner. It is a gateway to European and transatlantic markets, with a deep science base and sophisticated capital markets.

From a Singapore CFO’s perspective, the UK offers:

Singapore’s position as an Asian hub and the UK’s role as a European and global financial centre create a natural symmetry. Structuring R&D and innovation funding across both can give CFOs more flexibility on where to locate teams, IP and capital.

For all the opportunity, cross border R&D funding is not simple.

CFOs of Singapore headquartered groups typically face:

Without a structured approach, it is easy to miss incentives entirely, or to invite an enquiry because local claims are inconsistent.

FI Group specialises in R&D and innovation public funding across more than a dozen jurisdictions, including Singapore and the UK. We combine local tax and grant expertise with a single global methodology, so group finance teams get a coherent view of incentives instead of a patchwork of local advice.

For Singapore based companies collaborating with UK partners, our teams typically:

FI Group’s global teams have supported more than 15,000 clients and secured over €2 billion in tax incentives and grants in a single year, giving us a broad view of what “good” looks like in cross border R&D funding.

“When a Singapore headquartered business collaborates with the UK, you are no longer optimising a single regime. You are designing a funding architecture across currencies, tax rules and agencies. The companies that win are the ones that treat this as a strategic design problem, not an afterthought.”

Dr Fawzi Abou Chahine, Funding Director, FI Group UK

Global reach. Local expertise. Your HQ sees the full picture. Your teams feel the local support.

Before the detailed questions, make it explicit that every funding case is fact specific and that cross border projects will always need tailored advice.

What types of projects are funded under UK–Singapore Collaborative R&D Calls?

These calls support business led industrial research that can lead to new products, services or processes with strong market potential in Singapore, the UK or globally. Projects must be collaborative, involve at least one company in each country, and focus on genuine technological development rather than routine work.

Can a single project benefit from both Singapore’s EIS and UK R&D tax relief?

Yes, in principle the same underlying R&D can qualify in both jurisdictions, provided the costs are correctly allocated, there is no double benefit in either tax system and group transfer pricing is aligned. The claim mechanics are different in each country, so CFOs should model scenarios and document the allocation rationale carefully.

How should Singapore CFOs manage FX and cash flow when using UK grants?

Collaborative calls typically pay out against milestones and claims in local currency. Singapore HQs should forecast FX exposure, align grant claim timings with tax instalments in both countries and ring fence contingency for delays. A consolidated view of group funding flows is essential to avoid liquidity surprises.

Which sectors are most active in Singapore–UK R&D collaboration?

The most active areas reflect both countries’ industrial priorities, including life sciences, digital and AI, advanced manufacturing, financial technology and net zero technologies such as energy storage and low carbon industrial processes. These align with the focus of joint R&D calls and the broader strategic partnership.

When should we involve an external advisor like FI Group?

The best time is before you finalise the consortium structure, workshare and budget. That allows you to optimise which entity leads, where IP will sit, how costs are allocated and which mix of grant and tax incentives to target. Retrofitting funding design once the project has started is always more expensive.

For decades, Singapore’s appeal for international investors rested on its clear and competitive tax regime.

Through the Pioneer Certificate Incentive (PC) and the Development and Expansion Incentive (DEI), eligible companies could enjoy corporate income tax rates as low as 5% or 10%. The approach was straightforward and effective. In exchange for lower tax rates, multinational companies committed to invest in innovation, job creation, and capability building in Singapore.

Many European and French groups built their Asia-Pacific operations under these schemes. However, the introduction of the OECD’s BEPS 2.0 reforms has changed this model.

The Global Minimum Tax (GMT), under the Pillar Two framework, requires large multinational groups to maintain an Effective Tax Rate (ETR) of at least 15% in every jurisdiction. When a subsidiary’s ETR falls below that level, the home country, including France, can impose a Top-up Tax to bring the total tax back to 15%. Traditional low-rate incentives can therefore lose their value at the group level.

To maintain competitiveness, Singapore announced in Budget 2024 a new generation of investment incentive: the Refundable Investment Credit (RIC). The Economic Development Board (EDB) released the first detailed factsheet in December 2024, and by September 2025 the RIC legislation was fully enacted. With the framework now official and operational, it is an ideal moment to explore what the RIC means for French multinational corporations (MNCs) planning future investments in Singapore.

For French MNCs, the new global tax landscape is not simply a compliance challenge. It directly affects the financial outcome of overseas investments.

Under the GloBE rules, if a Singapore subsidiary receives a tax incentive that lowers its ETR below 15%, the French parent must pay a Top-up Tax in France. The result is neutral cash flow and no lasting benefit from the local incentive.

Tax executives now need to prioritise incentives that create real economic value without lowering the ETR. Singapore’s Refundable Investment Credit was designed to do exactly that.

The RIC is not a tax rate reduction. It is a refundable tax credit tied to specific, approved investments in Singapore.

It qualifies as a Qualified Refundable Tax Credit (QRTC) under the OECD’s Pillar Two rules. This means that the credit retains its value and does not trigger additional taxation at the parent company level.

How the RIC Works

This mechanism ensures that the RIC complies with Pillar Two and that the incentive’s value is preserved for the group even when minimum tax rules apply.

The OECD defines a Qualified Refundable Tax Credit (QRTC) as one that is refundable within a short, certain period and treated as income for accounting purposes rather than a reduction in tax expense.

The RIC meets both conditions. The refund must occur within four years, satisfying the “short period” requirement. Because it is refundable in cash, accounting standards treat the credit as other income, not as a tax deduction. This ensures that the ETR for Singapore remains above 15% when calculated under the GloBE methodology.

For French MNCs, this structure prevents the French parent from facing a Top-up Tax and ensures that the credit translates into a genuine financial benefit.

The RIC allows French companies to keep enjoying meaningful fiscal support for their Singapore operations while remaining compliant with global tax rules. It protects the value of investments in advanced manufacturing, digital technology, and green innovation.

When a Singapore subsidiary generates steady taxable income, the RIC offsets its tax liabilities.

When profits are lower or cyclical, the company can rely on the refund schedule to receive the cash value of the credit within four years. Either method maintains a compliant ETR.

Each RIC claim requires documentation proving qualifying expenditures and the fulfilment of agreed commitments.

The EDB issues a Letter of Confirmation outlining the amount awarded and the payment schedule. This record supports both local audits in Singapore and home-country reporting in France.

The official enactment of the RIC legislation in September 2025 marks a decisive step for Singapore. The country has repositioned itself from competing on headline tax rates to competing on certainty, liquidity, and compliance.

For French multinationals, Singapore now offers a rare combination: a stable legal environment, a transparent tax administration, and a globally compliant investment framework. The RIC provides predictability for capital-intensive projects in high-value sectors, especially for companies expanding manufacturing, research, or sustainability-driven operations in Asia.

The policy signal is clear. Singapore is committed to maintaining its role as a premier destination for international investment while fully aligning with the OECD’s global standards.

The Global Minimum Tax has redefined the logic of cross-border incentives. For French multinational corporations, Singapore’s Refundable Investment Credit (RIC) provides a compliant and financially efficient alternative to the old tax-holiday approach.

By guaranteeing refundability within four years, applying to a broad range of strategic activities, and aligning with Qualified Refundable Tax Credit criteria under Pillar Two, the RIC ensures that companies can still achieve real after-tax value from investing in Singapore.

Now that the RIC legislation is enacted and the framework is fully operational, French tax and finance leaders can plan their investments with confidence. Singapore’s incentives are no longer about lowering tax rates. They are about rewarding real, high-quality investment in ways that are consistent with the new global tax order.

The Refundable Investment Credit (RIC) is a powerful tax incentive designed to encourage substantial, high-value economic activities in Singapore. However, unlike general tax deductions, eligibility for the RIC is specific and subject to rigorous review, primarily by the Economic Development Board (EDB) and the Inland Revenue Authority of Singapore (IRAS).

This deep-dive guide from FI Group Singapore outlines the core criteria for eligibility, the industries typically prioritized, and the critical role of official legislation in your application.

Eligibility for the Refundable Investment Credit rests on satisfying three main criteria: the applicant company, the specific investment project, and the economic benefits delivered.

The company applying for the RIC must meet specific foundational requirements:

The RIC is not an automatic credit; it is tied directly to an approved investment project. A project is generally deemed eligible if it:

All claims must adhere strictly to the Income Tax Act (ITA) and the specific terms and conditions set out in the relevant Gazette Notification that formalizes the RIC scheme.

Key Takeaway: Eligibility is not just about the size of the investment; it’s about the strategic value and future-readiness of the project as assessed against government policy.

The EDB, in administering the RIC, focuses on investments that contribute to the long-term competitiveness and transformation of the Singapore economy. While the official list can be adjusted based on policy cycles, prioritized areas consistently fall under these high-growth, high-value categories:

| Prioritized Industry Cluster | Typical Investment Focus |

| Advanced Manufacturing & Engineering | Robotics, Additive Manufacturing (3D Printing), Smart Factory technologies, Aerospace MRO. |

| Digital Economy & Technology | Data Centres, Artificial Intelligence (AI) development, Cybersecurity solutions, Software R&D labs. |

| Biomedical Sciences | Pharmaceutical manufacturing, Medical device development, Clinical research facilities. |

| Green Economy & Sustainability | Carbon capture and storage (CCS) technologies, Renewable energy infrastructure, Sustainable materials innovation. |

| Innovation & R&D | Establishment of regional R&D headquarters, Intellectual Property (IP) creation and management, new product design. |

The EDB’s Criterion: Projects are assessed on their ability to create high-quality jobs, introduce new and critical capabilities into Singapore, and deepen technological expertise, solidifying Singapore’s status as a global hub.

Understanding the legislation is paramount, as the RIC is a discretionary incentive. This means the grant of the credit is at the discretion of the EDB and IRAS, not an automatic right. Pre-Application Approval is Mandatory

You must apply for and obtain prior approval from the EDB before incurring the qualifying capital expenditure.

The term Refundable Investment Credit means that if the credit granted exceeds the company’s corporate tax liability for that year, the balance of the credit can be refunded in cash to the company. This is what makes the RIC exceptionally valuable, particularly for companies in expansion or investment phases where taxable income might be low in the short term.

Book Your Free RIC Eligibility Consultation Today

For Multinational Corporations (MNCs) affected by the OECD’s BEPS 2.0 Pillar Two rules the classification of tax incentives is a major strategic concern.

The Refundable Investment Credit (RIC) is structured to be compliant with these new international tax rules:

The Status of RIC as a QRTC

The RIC qualifies as a Qualified Refundable Tax Credit (QRTC) under the Pillar Two framework. A tax credit is considered a QRTC if it is refundable in cash or can be used to settle other tax liabilities within a specific short period.

While the regulatory framework is clear, securing the maximum possible Refundable Investment Credit (RIC) requires a specialized, process-driven approach. FI Group Singapore is uniquely positioned to maximize your claim by bridging the gap between your finance team and the EDB’s strategic objectives.

Our service specifically addresses the three most common failure points for RIC applicants:

Our proven methodology is governed by a rigorous multi-stage approach, ensuring no detail is overlooked, from initial assessment to final disbursement. This proprietary process, detailed below, is what drives maximum claim success for our clients:

The Refundable Investment Credit offers one of the most powerful cash incentives for strategic investment in Singapore. However, the complexity of the eligibility criteria, the required detailed projections, and the mandatory pre-approval process mean that expert guidance from FI Group Singapore is necessary for optimal success.

Don’t risk submitting a suboptimal application or missing out on key qualifying expenditures.

Contact FI Group Singapore today for an Expert RIC Eligibility Consultation.

Singapore’s reputation as a global innovation hub is backed by a robust network of government agencies offering targeted grants and tax incentives. These programmes are designed to help businesses, from startups to large enterprises, accelerate R&D, adopt new technologies, and build future-ready capabilities.

In this guide, we explore the key government bodies present in Singapore and the innovation schemes they offer. Whether you’re looking to co-fund a digital transformation project or claim tax deductions for R&D, there’s a programme tailored to your needs.

Check out our Types of Grants In Singapore | 2025 Guide for CFOs and Founders.

EnterpriseSG is the government agency championing enterprise development. It supports startups and SMEs in building capabilities, innovating, and expanding internationally through targeted grants and programmes.

Key Programmes:

| Grant | Purpose | Funding |

| EDG | Business transformation | Up to 70% |

| CTC Grant | Worker-centric transformation | Up to 70% |

| T-Up | R&D capability via A*STAR secondment | Up to 70% |

| Startup SG Tech | Early-stage tech development | Up to S$800,000 |

| Resource Efficiency Grant for Emissions (REG(E)) | Emissions reduction through energy-efficient upgrades | Up to 70% for SMEs, capped at S$30,000 (Base Tier) or S$350,000 (Advanced Tier) |

EDB is Singapore’s lead agency for attracting investments and fostering innovation in high-value sectors. It supports companies undertaking strategic R&D and expansion projects that contribute to national economic priorities.

Key Programmes:

| Grant | Purpose | Funding |

| Research and Innovation Scheme for Companies (RISC) | Supports companies in expanding R&D teams and executing innovation projects that develop new or improved products or processes | 60% support for local manpower; 30% for foreign manpower and equipment |

| Refundable Investment Credit (RIC) | Encourages significant new or expanded investments in Singapore across manufacturing, services, and growth sectors | 10%, 30%, or 50% refundable tax credit on qualifying expenditures |

MAS is Singapore’s central bank and financial regulator. It drives innovation in the financial sector through the FSTI framework, supporting fintech, ESG, AI, and quantum technologies.

Key Programmes:

| Grant | Focus | Funding |

| FSTI Quantum Track | Quantum tech pilots | Up to 50% |

| FSTI Centre of Excellence | Financial innovation hubs | Up to S$250,000 |

| FSTI Innovation Acceleration | Nascent tech | Up to S$400,000 |

| ESG FinTech Grant | Sustainable finance | Up to S$500,000 |

| AIDA Grant | AI & analytics | Up to S$500,000 |

IMDA leads Singapore’s digital transformation agenda. It empowers businesses to adopt emerging technologies and build internal digital capabilities through strategic funding programmes.

Key Programmes:

| Grant | Purpose | Funding |

| Digital Leaders Programme (DLP) | Supports companies in building internal digital teams and implementing impactful digital transformation projects | Up to S$200,000 over 2 years for hiring up to 4 dedicated digital roles |

MPA promotes innovation in the maritime sector, supporting companies in developing advanced technologies and intellectual property that enhance Singapore’s position as a global maritime hub.

Key Programme:

| Grant | Purpose | Funding |

| MINT – Research & Product Development (MINT-RPD) | Supports maritime companies in developing technologies and IP through R&D, test-bedding, and commercialisation | Co-funding of up to 50% of qualifying project costs |

The Building and Construction Authority (BCA) drives transformation in Singapore’s built environment sector. It supports firms in adopting advanced technologies, improving enterprise capabilities, and upskilling manpower to meet evolving industry standards.

Key Programme:

| Grant | Purpose | Funding |

| Built Environment Technology and Capability (BETC) Grant | Supports holistic transformation in construction through tech adoption, enterprise development, and manpower upskilling | Up to 70% (SMEs), up to 50% (non-SMEs) |

IRAS offers tax-based innovation support via the Enterprise Innovation Scheme (EIS).

At FI Group Singapore, we go beyond identifying funding opportunities—we guide you through every stage of the grant journey. From analysing your innovation roadmap to matching the right grants, managing applications, and ensuring post-approval compliance, our structured process is designed to maximise your success.

Whether you’re applying for EnterpriseSG grants or claiming EIS tax benefits, our expert team ensures your innovation efforts are fully supported.

What types of businesses can apply for Singapore innovation grants?

SMEs, startups, and large enterprises across sectors can apply, depending on the grant’s scope and eligibility criteria.

Can I combine grants with tax incentives like the Enterprise Innovation Scheme?

Yes. Many companies use grants for upfront funding and EIS for tax optimisation or to receive a cash payout of up to S$100,000 annually.

How do I know which grant suits my project?

FI Group offers tailored advisory services to help match your innovation goals with the most suitable funding scheme, whether it’s a grant or a tax incentive.